How to Vote for Your Investment

It’s almost election time, and this year everyone hates the Democrats – except the Democrats, of course – but is it smart to vote for the Republicans?

This time around, yes, but sometimes it’s smart to vote for the Democrats, too.

Basically, if you always vote for your investments, you’ll find yourself voting for both sides of the isle, at one time or another.

Bubbles, man. Market bubbles.

So what the heck are we talking about?

Buy & Hold, or Flip

Everyone has seen or experienced a market bubble, but few people seem to understand how they’re created. Well, lucky for you, we’re going to pull back the curtain and reveal the absolute, all-time secret to successful real estate investing.

You’re going to kick yourself for not realizing it sooner.

Regardless of what you’re investing in – whether it’s stocks, real estate, gold or rare automobiles – there are peaks and valleys to every market. Knowing what causes the peaks and valleys is what helps the rich get richer.Don’t Blow It!Those who don’t understand how bubble markets work, end up:

- …holding too long

- …buying at the top

- …or buying after the bubble bursts.

If you’ve done any kind of investing before, then you’ve probably done one of these 3 things. The reason why is because you were not prepared for any of it.

Long Term vs Short Term Strategies

No one wants to wait a long time to get rich, but timing is everything, and sometimes a windfall or significant injection of capital is unpredictable. Investing in tangible assets when you have money and adopting a “buy and hold” strategy is more about timing than it is strategy. There will always be bubbles in every investment cycle. The difference between a long-term or short-term investing strategy is knowing when the bubble is going to grow and burst.

As investors, we know that capital needs to be invested quickly, otherwise it will be spent. There are always improvements that need to be made and everyone wants to drive a nicer car, but if you KNEW when the market was going to take off and peak, you would probably be a little smarter with your money.

So what do bubbles have to do with voting?

Democrats

Consider what Democrats stand for. The party platform asserts that government spending provides “good jobs and will help the economy today.”

This is relatively true.

If you look at statistics (and who doesn’t love statistics ), Democrats are better at creating jobs, thereby stimulating the economy in a manner that results in slow, steady growth. Basically, if everyone has a job, then everyone will spend money.

Come on, Republicans! Don’t get mad! Statistics don’t lie. Regardless, that’s NOT what we (INVESTORS) are interested in.

The reason people don’t believe statistics (relative to politics) is because the aftereffects of a president’s (or other politician’s) term may not be felt until YEARS after they’re out of office.Many Democrats are adherents to Keynesian economics, or aggregate demand, which holds that when the government funds programs, those programs pump new money into the economy.

Keynesians believe that prices tend to stay relatively stable and therefore any kind of spending, whether by consumers or the government, will grow the economy.

So, after 8 years of DEMOCRAT managed “stability”, we’re ready to shake things up. We’re tired of boring, slow economic growth. We (Americans) want it (food, money, sex, 70″ TV’s, profits) NOW!

Government Managed Growth

Think about this: “…when the government funds programs, those programs pump new money into the economy.” New money means MORE money – for me and you.

There are times when government funding is good for investors, and there are times when it’s not. That’s why it’s important to know history.

A quick analysis of federal housing funding will show that both Democrats AND Republicans have approved measures and supported funding for AFFORDABLE housing for low and middle income Americans. These measures and funding regard mortgage rates, building, rehabilitation of neighborhoods and more. All of these things either create more inventory, or put a stress on the current inventory.

Why vote for the Republicans this time?

- Smaller government

- Lower Taxes

- Free Market Enterprise

- Trickle Down Economics

That of course has nothing to do with REALITY.

The times: They are a’changin’… again.

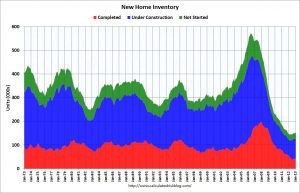

Currently, America is enjoying very low interest rates, resulting in a steady increase of general home purchases and housing starts (new homes being built).

While things are pretty good now, they’ll get even better under the Republican control. This is why:

Within the first term of a Republican takeover, Obamacare will be repealed (or replaced), and small business owners will get a little tax relief as themarginal tax rate recedes. Bank accounts will swell a little, and credit scores will rise. Consumers will then start shopping for bigger and/or newer houses. To prevent a bubble, the FED will try to correct the market and curb spending by increasing interest rates… and this is the start of the fireworks. At this point, banks will see an opportunity to make money on new lending, and they will create pressure on the general public to “purchase while interest rates are still low“.

We all know what happens next.

*BUURRRP*

You’d either have to be stupid or crazy to be a politician, and it seems we elect the former more often than the latter. Good for us, as it makes predicting their behavior much easier.

Right now, take the advice of Warren Buffett: “You can only buy when everyone else is selling if you have held your fire when everyone was buying.” You can apply this advice directly to any investment market – especially real estate.

So, if you have capital, BUY houses, condos and other rental properties now, AND HOLD. Rent them out. Make some subtle improvements to keep them rented, and just be patient.

Within 2 years after the election of a Republican President, you’ll see the bubble start forming, and it’ll take 3 or 4 years to really build.

Currently, as real estate investors, we’re in a great position. The housing market is very stable and there is just enough demand for new houses that all housing values are gradually increasing. When the Republicans take office in 2016, educated real estate investors will start licking their lips and wringing their hands as the general consumer population thinks about how they can get a bigger house with all of the extra money they’re making at work and the money they’ve saved on taxes.

SELL!

3 to 5 years (2019 – 2021) after the election of a Republican President in 2016, when EVERYONE seems to be talking about getting INTO the real estate market, that’s the point you need to sell… and that’s when educated real estate investors WILL sell. In fact, that’ll be the point when the bubble is actually recognized as a “bubble”. Interest rates will start rising IN RESPONSE to the increase in home sales.

And the beast will start feeding on itself!

Our actions of selling when everyone seems to be buying is what creates the final surge to the peak of the frenzy. Then, when OUR actions of selling stop, and the interest rates are so high that consumers and investors stop buying… the market will correct itself, and the entire housing market will do a repeat of 1973, 1979, 1989, 1996 and 2006/07. The weekend investment warriors and shade tree investors will quickly pull out and cut their losses. Foreclosures will increase again, and in 5 years we’ll be buying all over again with a NEW long term strategy in mind.

That’s also how the stock market works, and why the majority of new stock investors also lose money.

Peaks Don’t Exist

Many new real estate investors will 2nd guess themselves for selling too early and not getting the optimum value for their real estate investment. What they don’t realize is that they got out right on time, as it was their ACTIONS that contributed to the creation of the market peak. In fact, selling at the top of the market is IMPOSSIBLE, because the peak market value for real estate is really just carried upward by momentum of the buying frenzy. The value peak of any property is the value point where people begin to say “no”. Once the buyers begin saying “no”, values ALL begin sliding back down.

History of Federal Housing Legislation and Other Stuff

George Santayana, a Spanish philosopher, said “Those who cannot remember the past are condemned to repeat it.” So, if you’re bored or actually interested in learning more about all of this stuff, here’s list:

LBJ

- 1963 Great Society antipoverty programs

- Housing Act of 1965

- 1968 Fair Housing Act prohibiting discrimination & Ginnie Mae

Nixon

Nixon declares moratorium on housing and community development assistance in 1973, after appointing George Romney HUD Secretary in 1969.

Ford

1974 Started Section 8

Gave money to city and state governments to renew neighborhoods

Carter

1977 Community Reinvestment Act, Housing and Community Development Act of 1977

Reagan

Developed Tax incentives, low interest loans and Insurance programs to encourage home ownership.

1986 Tax Credit to Developers to build low income housing (resulted in 800,00 units of rental housing)

1987 McKinney–Vento Homeless Assistance Act

1990 Crantson-Gonzalez National Affordable Housing Act

Summary

When Republicans are elected after Democrats have been in control, the first thing they do isstart slashing taxes to stimulate the economy and accelerate growth. The “trickle down” effect is supposed to result in companies hiring more employees, but only drug addicts would think that hiring more employees would miraculously result in more revenue. CEO’s and business owners who are AWAKE look at those tax cuts as additional capital. They stop buying lottery tickets and instead invest in less risky assets like real estate, stocks and collectibles.

And so it begins…

Buying and holding real estate is essentially buying and renting it out. The time to start selling is when EVERYONE is buying. The time to start buying back is when EVERYONE is selling.

In 2016, put your investments first, and vote Republican.

To see the future, we must look at the past. If you take time to look at all of our housing bubbles, they all started with government intervention, resulting in the collapse when the plug was pulled on the program.

Tax breaks for home BUYERS creates a sellers market, inflating home values. Government funding provided to builders to create more affordable housing increases the inventory of homes, thereby bringing the values of the current inventory down.

For every push, there is a pull. For every Yin, there is a Yang.

If you know who is likely to do what and WHY they are likely to do it, then you can more accurately anticipate the next market inflation, the market peak and the bubble burst.

That’s why America is going to vote for a Republican President in 2016 – and in all honesty, it doesn’t matter who the Republican candidate is. With few exceptions, every elected official is a tool of their party. That means that they will do whatever the party wants.

So, what does the party want?